What is the Best Stock Trading Robot for Automated Forex Trading?

When it comes to achieving success in financial markets, many traders are turning to advanced technologies like automated trading systems. These systems, often referred to as “stock trading robots,” have revolutionized the way people trade by eliminating emotional decision-making and enhancing efficiency. But how do you find the best stock trading robot for automated forex trading? This article explores everything you need to know about automated trading systems and how to choose the best one to meet your trading goals.

What Is Automated Forex Trading?

Automated forex trading is the process of using specialized software or algorithms to execute trades in the forex market without the need for constant manual intervention. These systems are designed to analyze the market, identify trading opportunities, and execute trades on your behalf.

By using an automated trading system, traders can benefit from faster execution, reduced emotional bias, and the ability to trade around the clock. Automated forex trading is especially useful for those who lack the time or expertise to monitor the markets continuously.

Do you want to visit Char Dham? Char Dham Travel Agent is the best place to plan your Char Dham tour. You can book the tour from here.

How Do Stock Trading Robots Work?

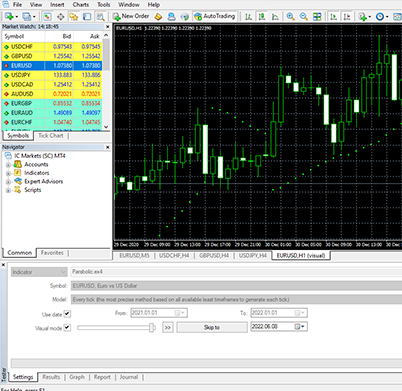

Stock trading robots, also known as algorithmic trading systems or expert advisors (EAs), rely on pre-programmed rules and strategies to make trading decisions. These robots analyze market trends, identify entry and exit points, and execute trades automatically based on the parameters set by the user.

For forex traders, stock trading robots are particularly beneficial because they can process vast amounts of data and react to market movements in real-time. This speed and precision can lead to better outcomes compared to manual trading.

Why Should You Use a Stock Trading Robot for Automated Forex Trading?

Using a stock trading robot offers numerous advantages, especially for forex traders. Below are some key reasons why automated trading systems are becoming increasingly popular:

Would you like to visit Indiar? A tour operator in India is the best place to plan your tour. You can book a tour from here.

- Eliminates Emotional Trading: Emotional decision-making often leads to poor trading choices. Stock trading robots operate purely based on logic and pre-set rules, ensuring that trades are executed without fear or greed.

- 24/7 Market Monitoring: Forex markets operate 24 hours a day, five days a week. Automated systems can monitor the markets constantly, ensuring you never miss an opportunity.

- Backtesting Capabilities: Before deploying a strategy in live markets, traders can use stock trading robots to backtest their strategies on historical data. This allows them to refine and optimize their approach.

- Time-Saving: Automated trading frees up time for traders, enabling them to focus on strategy development rather than execution.

- Faster Execution: Automated systems can execute trades much faster than humans, which is critical in fast-moving forex markets.

What Features Should the Best Stock Trading Robot Have?

Not all stock trading robots are created equal. To find the best one for automated forex trading, look for the following features:

- Customizable Strategies: The ability to create and modify trading strategies is essential. Look for robots that allow you to tailor their settings to align with your trading goals.

- User-Friendly Interface: Whether you’re a beginner or an experienced trader, the software should be easy to navigate.

- Backtesting Functionality: A reliable stock trading robot should allow you to backtest your strategies on historical data to ensure effectiveness.

- Risk Management Tools: Risk management is critical in forex trading. The best robots come with features like stop-loss orders, take-profit levels, and position sizing.

- Compatibility: Ensure that the robot is compatible with your trading platform, such as MetaTrader 4 or MetaTrader 5.

- Reputation and Reviews: Always research user reviews and testimonials before investing in a stock trading robot. A good reputation is often a strong indicator of reliability.

What Are the Risks of Automated Forex Trading?

While automated forex trading offers many benefits, it’s essential to be aware of the risks:

- Technical Failures: Automated systems rely on technology, and technical glitches can occur. For example, a poor internet connection or software bug could lead to missed trades.

- Over-Optimization: Some traders over-optimize their robots during backtesting, leading to strategies that perform well on historical data but fail in live markets.

- Market Unpredictability: No system can predict market movements with 100% accuracy. It’s essential to use risk management tools to protect your capital.

- Costs: High-quality stock trading robots often come with a price tag, either as a one-time fee or a subscription. Ensure that the potential returns justify the cost.

How to Choose the Best Stock Trading Robot for Automated Forex Trading

Selecting the right stock trading robot requires careful consideration. Follow these steps to make an informed decision:

Would you like to visit Haridwar? Travel agents in Haridwar are the best place to plan your trip. You can book your tour right here.

- Define Your Goals: Are you looking for short-term profits, long-term growth, or a mix of both? Your trading goals will influence the type of robot you choose.

- Do Your Research: Read reviews, check forums, and compare different options. Look for robots with a proven track record of performance.

- Test the Robot: Before committing, test the robot on a demo account. This allows you to evaluate its performance without risking real money.

- Consider Costs: Compare the price of the robot to its features and potential benefits. Avoid overly expensive options unless they offer significant advantages.

- Evaluate Customer Support: Good customer support is essential, especially if you encounter technical issues.

Are There Free Stock Trading Robots for Automated Forex Trading?

Yes, there are free stock trading robots available, but they often come with limitations. While they may be a good starting point for beginners, advanced traders may require more robust features found in paid options.

When using free robots, be cautious and conduct thorough testing. Some free systems may lack reliability, and their performance can vary significantly.

What Are the Best Practices for Automated Forex Trading?

To maximize the benefits of automated forex trading, follow these best practices:

- Regular Monitoring: Even though trading robots are automated, regular monitoring is essential to ensure they’re functioning correctly.

- Keep Learning: The forex market is constantly evolving. Stay updated on market trends and refine your strategies accordingly.

- Diversify Your Portfolio: Don’t rely solely on one robot or strategy. Diversification can help spread risk.

- Start Small: Begin with a small investment and gradually increase your capital as you gain confidence in the system.

Conclusion: Which Stock Trading Robot Is Right for You?

The best stock trading robot for automated forex trading depends on your individual needs and preferences. Whether you’re a beginner looking for a simple system or an experienced trader in search of advanced features, there’s a robot out there for you.

Take the time to research, test, and optimize your chosen system. With the right tools and strategies, automated forex trading can be a powerful way to achieve your financial goals.

By following this guide, you’ll be better equipped to navigate the world of automated forex trading and find the best stock trading robot to suit your needs. Always remember, no system guarantees success, so approach trading with caution and a clear strategy.