Upcoming Big IPO in India – A Golden Opportunity for Investors

Upcoming Big IPO in India : A Game Changer for Investors

India’s stock market is buzzing with excitement as several companies are gearing up to launch Initial Public Offerings (IPOs) in the coming months. IPOs present a golden opportunity for investors to become part of a company’s growth story right from the beginning. But with so many options, how do you choose the right one? And how do you prepare yourself to invest wisely? In this article, we’ll explore some of the most anticipated upcoming big IPOs in India and provide helpful insights for those looking to make the most of these opportunities.

If you’re new to the world of stock markets or looking to brush up your knowledge, understanding IPOs can be the perfect entry point. Before diving into the specifics, though, it’s always beneficial to educate yourself. Learning through the best stock market course or participating in stock trading courses in India can help you make informed decisions when investing.

Discover Upcoming big ipo in india and learn how to invest wisely. Boost your knowledge with the best stock market course and stock trading courses India.

Do you want to visit Char Dham? Char Dham Travel Agent is the best place to plan your Char Dham tour. You can book the tour from here.

What is IPO ?

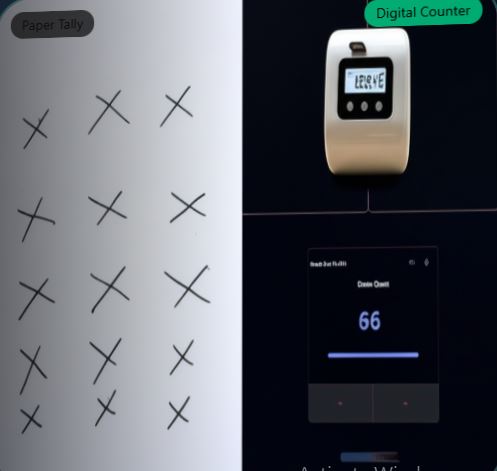

An Initial Public Offering (IPO) is when a private company offers its shares to the public for the first time. Think of it like a small shop opening its doors to a large mall, where anyone can now walk in and buy shares. For companies, it’s a way to raise capital, and for investors, it’s an opportunity to own a piece of that company.

In simple terms, when a company “goes public,” they sell part of their ownership to the general public. Once listed on a stock exchange, these shares can be bought and sold freely by investors.

Why Do Companies Go Public?

Companies opt for IPOs for several reasons. They want to raise capital for expansion, pay off debts, or even improve their brand recognition. Going public also allows early investors or founders to exit or reduce their stake while bringing in fresh investors.

Would you like to visit Indiar? A tour operator in India is the best place to plan your tour. You can book a tour from here.

But why is this relevant to you as an investor? Investing in an IPO allows you to ride the wave of a company’s growth from the beginning. However, like every investment, it comes with risks. So, before diving in, it’s a good idea to educate yourself with a course stock market basics or even specific classes on share market strategies.

Upcoming big ipo in india : What to Expect

India is set to witness several major IPOs in the coming months, drawing the attention of seasoned and new investors alike. Some of the most anticipated IPOs include:

- OYO Rooms: The hospitality giant is looking to tap the public markets after years of private fundraising.

- LIC (Life Insurance Corporation of India): A historic IPO, LIC’s offering is poised to be one of the largest ever in India’s history.

- Mobikwik: A key player in the digital payment space, Mobikwik’s IPO could draw significant interest due to its role in India’s digital economy.

These companies represent diverse sectors, giving investors options based on their interests. Whether it’s hospitality, insurance, or fintech, you’ll want to keep an eye on these IPOs.

Would you like to visit Haridwar? Travel agents in Haridwar are the best place to plan your trip. You can book your tour right here.

Factors Driving the IPO Boom in India

What’s causing this sudden surge in IPO activity? Here are some reasons:

- Economic Growth: India’s rapid economic expansion has provided fertile ground for companies to scale.

- Increased Investor Appetite: The growing middle class and access to trading platforms have driven more retail investors to participate in IPOs.

- Global Interest: Foreign institutional investors are pouring funds into India, especially in sectors like tech and fintech.

It’s also important to note that government reforms and initiatives aimed at increasing transparency and ease of business have contributed to this IPO boom.

How to Evaluate a Good IPO for Investment

Not all IPOs are created equal. Some might look like golden opportunities but could result in losses if the fundamentals aren’t strong. So, how do you evaluate whether an IPO is worth investing in?

- Company’s Financial Health: Look at the company’s balance sheet, profitability, and debt levels.

- Industry Growth: Is the industry the company operates in expected to grow?

- IPO Valuation: Compare the company’s IPO price with similar companies in the market.

- Management Team: A strong leadership team often means the company is in good hands.

Taking a stock market course in India can help you develop a better understanding of how to assess such factors critically.

Should You Invest in an IPO?

Before deciding whether to invest in an Upcoming big ipo in india , ask yourself these questions:

- Do you understand the company and its growth prospects?

- Are you prepared for the potential volatility that IPOs often experience?

- Have you done enough research or taken a stock trading course to make informed decisions?

While IPOs can offer substantial returns, they can also be risky, especially if you’re not fully prepared. Consider taking stock market courses to get a solid foundation before investing.

Steps to Apply for an IPO in India

Applying for an IPO is simpler than ever, thanks to digital platforms. Here’s a step-by-step guide:

- Open a Demat Account: You’ll need a Demat account to hold the shares.

- Check IPO Details: Look for the opening and closing dates, price band, and company details.

- Apply Through ASBA (Application Supported by Blocked Amount): Most banks offer this service, allowing you to apply through your net banking account.

- Wait for Allotment: After the IPO closes, you’ll find out if you’ve been allotted shares.

Many stock trading courses in India cover these steps in detail, ensuring you’re well-prepared to participate.

The Role of Stock Market Education in IPO Investing

Investing in IPOs isn’t just about luck—it’s about knowledge and timing. The more you know, the better your chances of making smart investments. By enrolling in the best stock market course or taking classes on share market strategies, you can hone your skills and better understand how IPOs fit into the larger stock market ecosystem.

Best Stock Market Courses to Enhance Your Skills

To get the most out of upcoming IPOs, here are some recommended stock market courses:

- Stock Market Institute of India : Offers in-depth training on stock trading and IPO analysis.

- Trendy Traders Academy: Perfect for beginners looking to understand stock trading in India.

- National Institute of Securities Markets (NISM): Offers certified courses that cover stock trading and investment strategies.

These courses can empower you with the tools needed to navigate IPOs and the broader stock market.

Benefits of Learning through Stock Trading Courses

Why should you invest in a stock trading course?

- Better Decision Making: You’ll learn to analyze stocks and IPOs effectively.

- Reduced Risk: With a deeper understanding of the market, you’ll be less likely to make impulsive, risky investments.

- Confidence: You’ll feel more confident participating in IPOs and other stock market opportunities.

Common Mistakes to Avoid When Investing in IPOs

When it comes to Upcoming big ipo in india investing, even seasoned investors can make mistakes. Here are some common ones to avoid:

- Rushing In: Just because an IPO is hyped doesn’t mean it’s a good investment.

- Not Doing Enough Research: Don’t skip the homework. Study the company’s financials and the market.

- Ignoring Valuation: Ensure the IPO price reflects the company’s true value.

- FOMO (Fear of Missing Out): Don’t invest just because everyone else is.

Taking a course on stock market strategies can help you avoid these pitfalls.

Conclusion: The Upcoming big ipo in india

Upcoming big ipo in india market is set for exponential growth, with many companies ready to go public in the near future. For investors, this means exciting opportunities, but also risks. Whether you’re a seasoned investor or a beginner, the key to success lies in preparation and education. By exploring classes of share market and classes about stock market in India, you’ll be well-equipped to make informed decisions in the IPO space.

FAQs

1. What is IPO , and how does it work?

An IPO is when a company offers its shares to the public for the first time. Investors can buy shares, and once listed on a stock exchange, these shares can be traded freely.

2. Are IPOs risky investments?

Yes, IPOs can be risky due to the uncertainty around the company’s future performance. It’s important to research thoroughly before investing.

3. How can I apply for an IPO in India?

You can apply for an IPO through your Demat account using the ASBA (Application Supported by Blocked Amount) method available via net banking.

4. Can beginners invest in IPOs?

Yes, but it’s advisable to educate yourself by taking stock trading courses in India to understand the risks and opportunities.

5. What is the role of stock market courses in IPO investing?

Stock market courses provide the knowledge needed to evaluate IPOs, understand market trends, and make informed investment decisions.