Understanding Bond Yields & the Yield Curve: A Complete Guide

A yield on a bond and a yield curve are issues every investor needs to be knowledgeable about. In addition to offering a basis for evaluating an investment in bonds, these instruments also serve as gauges for the overall economy. If you are new to bonds or fine-tuning your approach, this guide will simplify these concepts and demonstrate how you can use them.

What is Bond Yield?

The return an investor earns from a bond is called the bond yield. It’s expressed simply as a percentage of price, but a fixed interest rate-coupon on bonds is given, and their market prices usually change accordingly.

For example, if you buy a ₹1,000 bond with a coupon rate of 5%, you will get ₹50 per year. If the market price of the bond drops to ₹900, then the yield increases because you are getting the same ₹50 on a lower buying price. When the price goes up to ₹1,100, the yield falls. Yields on bonds are a first-order leading indicator of market conditions.

Do you want to visit Char Dham? Char Dham Travel Agent is the best place to plan your Char Dham tour. You can book the tour from here.

Types of Bond Yields

1. Nominal Yield

It is the fixed annual coupon rate expressed as a percentage of its face value. Thus, for instance, a 5% coupon bond on an ₹1,000 face value has a nominal yield of 5%.

2. Present Yield

This considers the bond’s current market price. It’s calculated as:

Current Yield =Annual Coupon PaymentMarket Price of the BondCurrent Yield=Annual Coupon Payment/Market Price of the Bond

Would you like to visit Indiar? A tour operator in India is the best place to plan your tour. You can book a tour from here.

3. Yield to Maturity -YTM

YTM is the net return an investor can expect from holding a bond to its maturity date, based on its current market price and coupon payments plus any realized capital gains or losses. YTM is a comprehensive measure of potential returns from a bond.

4. Bond Amortization

In the context of bonds, amortization refers to the gradual reduction of a bond’s premium or discount over its life. This adjustment ensures that the bond’s book value aligns with its face value as it approaches maturity. Understanding bond amortization is important for accurately assessing the bond’s yield and true cost.

What is the Yield Curve?

The yield curve is a graphical illustration describing the yields of different bonds with various maturities. It describes how the time to maturity behaves to the yield offered by almost credit equivalent bonds.

Would you like to visit Haridwar? Travel agents in Haridwar are the best place to plan your trip. You can book your tour right here.

Most yield curves have one of three shapes:

Normal Yield Curve: Upward-sloping, indicating higher yields for longer-term bonds. This reflects investor expectations of economic growth and inflation.

Downward Inverted Yield Curve: When short-term bonds offer more yields than long-term bonds. This is typically regarded as a sign of economic deceleration and recession.

Flat Yield Curve: Yields are similar across all maturities, indicating market uncertainty or a transition between economic phases.

Why are Bond Yields Important?

Bond yields are truly very important in investment decisions and even in economic analysis. Yields help in determining and comparing the returns of a bond with other alternative investment opportunities. Rising yields usually indicate a monetary policy tightening, and falling yields herald an easing for the economy. The yield curve is most specifically and closely watched for signs of economic health.

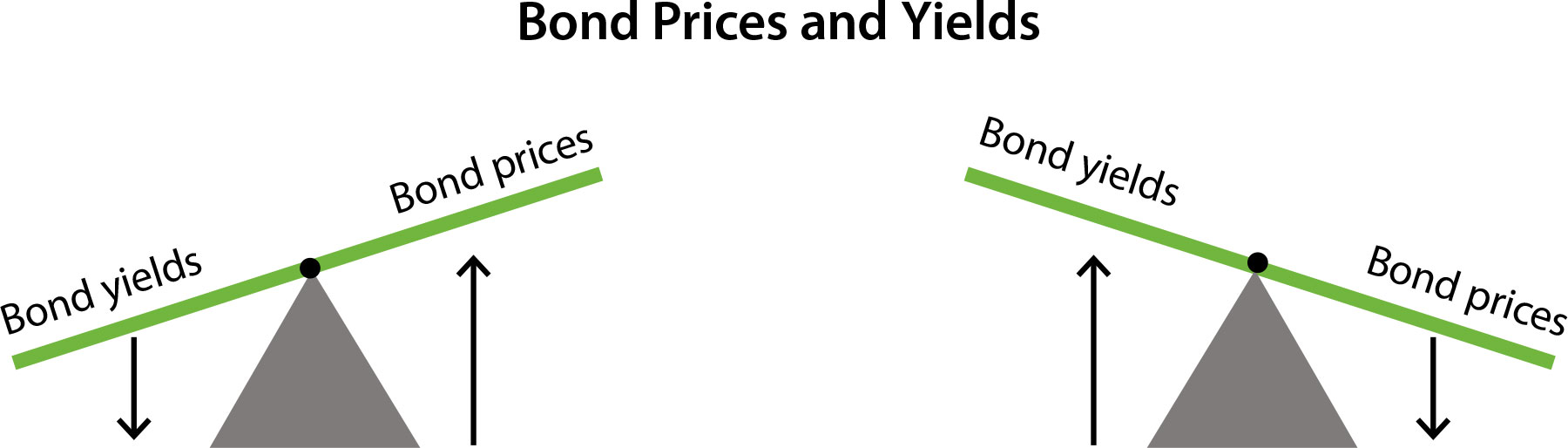

The Relationship between Bond Yields and Interest Rates

Bond yields and interest rates are inversely related. That is, if interest rates rise, then so do bond yields-as yields increase, prices decrease. If interest rates decline, then so do bond yields-as yields decline, prices rise. For instance, in a rising interest rate environment, it’s an understanding that newly issued bonds tend to have a better yield than existing ones.

How to Use Bond Yields and the Yield Curve

- Use yields to compare bonds and identify those that align with your return expectations.

- Monitor the yield curve, which predicts most leading indicators of economic cycles.

- Select bonds that have yields and maturities commensurate with your risk tolerance and investment horizon.

Final Thoughts

Understanding bond yields and the yield curve is key to making informed investment decisions. These tools provide valuable insights into a bond’s performance and the broader economic environment.

Whether you’re evaluating individual bonds or keeping an eye on market trends, mastering these concepts will enhance your investment strategy. With this knowledge, you’re better equipped to navigate the complexities of the bond market and achieve your financial goals.