Top 5 Tips for Effective DIY Credit Repair with Creditfixrr Technology LLC

Repairing your credit doesn’t have to be complicated. Many people are turning to DIY credit repair as an affordable and empowering way to improve their credit scores. By using the right tools and strategies, individuals can tackle credit repair on their own. In this article, we will cover the top 5 tips to help you successfully repair your credit using credit repair software, including the helpful tools offered by Creditfixrr Technology LLC.

1. Understand Your Credit Report

Before taking action, it’s essential to understand your credit report. This document provides a detailed history of your credit, including loans, credit card balances, and any negative marks like missed payments. To start your DIY Credit Repair, pull your credit report from the three major bureaus: Equifax, Experian, and TransUnion. This will give you a clear picture of your financial standing and help you identify areas that need improvement.

2. Dispute Inaccurate Information

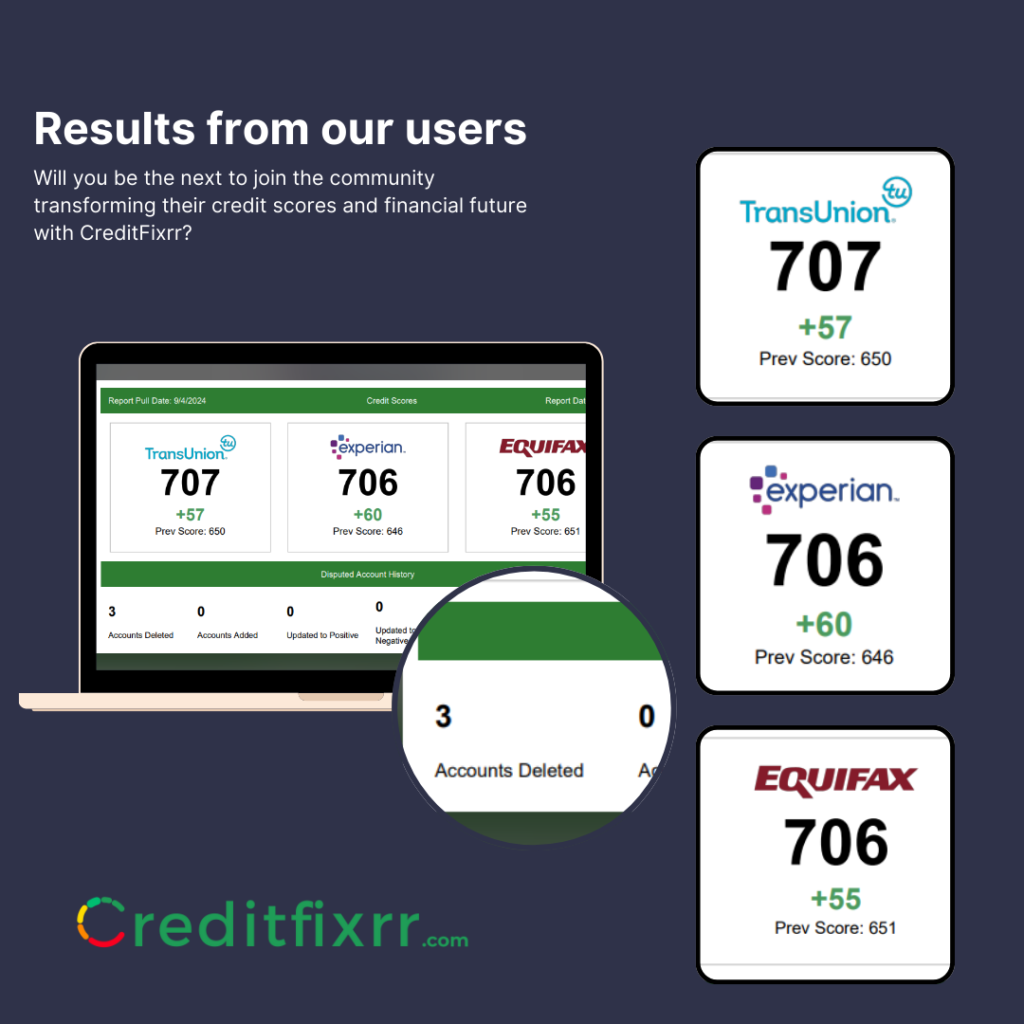

One of the most effective ways to improve your credit score is by disputing inaccurate information on your credit report. If you find any errors, such as incorrect late payments or unfamiliar accounts, you can challenge them with the credit bureaus. Credit repair software can help streamline this process, allowing you to easily track and automate disputes. DIY credit repair software also provides templates and step-by-step instructions to simplify filing disputes.

Do you want to visit Char Dham? Char Dham Travel Agent is the best place to plan your Char Dham tour. You can book the tour from here.

3. Pay Down High-Interest Debt

High debt, especially from credit cards, can significantly harm your credit score. As part of DIY credit repair, focus on paying down high-interest debts first. One popular method is the debt avalanche strategy, where you pay off the debts with the highest interest rates. Many credit repair software programs, including those offered by Creditfixrr Technology LLC, come with budgeting tools to help you track and manage your payments effectively. By reducing your debt, you’ll improve your credit utilization ratio and boost your score.

4. Negotiate or Remove Negative Accounts

Negative accounts, such as defaults or charge-offs, can remain on your credit report for years. These marks can lower your score, but you can take action to reduce their impact. Credit repair software can assist in identifying these negative accounts and suggesting actions, whether it’s negotiating a settlement with creditors or asking for a goodwill deletion. With DIY credit repair, you are in control of the process and can determine the best strategy for each account.

5. Monitor Your Progress Regularly

Credit repair is an ongoing process, and it’s important to stay consistent. Regularly monitor your credit report to see how your efforts are paying off. Many credit repair software tools allow you to track changes in your credit score and monitor the effectiveness of your actions. As you continue to dispute inaccuracies and pay down debt, you’ll notice improvements in your score over time.

Would you like to visit Indiar? A tour operator in India is the best place to plan your tour. You can book a tour from here.

In conclusion, repairing your credit is a gradual but achievable process. By leveraging DIY credit repair software from reliable companies like Creditfixrr Technology LLC, you can empower yourself to take control of your financial future. Whether you’re disputing inaccuracies, managing debt, or seeking to improve your creditworthiness, these tips will set you on the path to success in credit repair.

Remember, repairing your credit is a marathon, not a sprint, and consistency is key. Use the right tools, stay diligent, and watch your credit score improve over time.

For more information, contact us:

Would you like to visit Haridwar? Travel agents in Haridwar are the best place to plan your trip. You can book your tour right here.

Creditfixrr Technology LLC

8 The Green #5913, Dover, DE 19901

(410) 541-1018