Tips On How To Calculate The Cost Of Items Offered

The WAC methodology calculates a weighted common cost based on COGS and inventory spending. To decide WAC, divide the value of items bought by the total variety of models to get the average cost per unit. Your industry and product sort decide what you embrace in COGS calculations. For example, an ecommerce store could consider the value of wholesale merchandise, stock storage and website bills when figuring out COGS. A restaurant, however, calculates COGS using food, labour and overhead prices.

Solely these overhead prices which might be immediately attributed to the manufacturing of the goods are counted within COGS. Indirect costs like marketing bills or office provides for your administrative staff aren’t included. Whereas you’re not selling bodily items, COGS can include the labor costs, software subscriptions, or supplies you utilize to ship the service. Even small improvements can considerably have an result on enterprise profitability. Businesses use totally different accounting strategies to calculate COGS, affecting how inventory prices are recorded and reported.

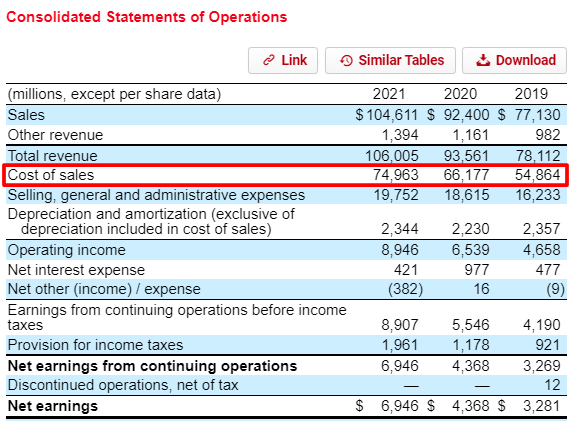

Value Of Gross Sales Vs Price Of Goods Bought: What’s The Difference?

At the tip of the quarter, you might have $20,000 of inventory remaining. The above example shows how the cost of items offered may appear in a bodily accounting journal. A firm ought to compare its COGS to business benchmarks to assess price efficiency. Ending stock prices can be decreased for damaged, worthless, or out of date inventory.

Do you want to visit Char Dham? Char Dham Travel Agent is the best place to plan your Char Dham tour. You can book the tour from here.

It consists of leftover stock from the previous interval and can be found within the company’s stability sheet under stock. At the top of each quarter or time period, use your accounting software or the price of goods offered formula above to calculate COGS. Re-verify your goods purchased, goods sold, and present inventory to find a way to search for loss or theft. Pure service corporations may calculate “cost of services” or “cost of income sales – cost of goods sold.” COGS isn’t on their income statement. The COGS calculation course of lets you deduct all the prices of the products you promote, whether you manufacture them or buy and re-sell them. Record all prices, together with cost of labor, price of supplies and supplies, and different prices.

The Revenue Assertion Format For A Trading Enterprise (multiple Step)

Would you like to visit Indiar? A tour operator in India is the best place to plan your tour. You can book a tour from here.

Airlines provide food and drinks to passengers, and motels would possibly promote souvenirs and spa products. For example, a producer like a toy firm would have COGS that embody the price of plastic and different materials used in manufacturing, as nicely as the wages of manufacturing facility employees. This deduction is on the market for companies that produce or purchase goods on the market. In accounting, debit and credit score accounts ought to always steadiness out. Stock decreases because, because the product sells, it’s going to take away out of your inventory account.

- It’s one of the largest indicators of income, revenue, and business sustainability.

- Calculating the price of items offered (COGS) for products you manufacture or sell may be sophisticated depending on the number of products and the complexity of the manufacturing course of.

- COGS seems in the identical place, however internet earnings is computed in one other way.

- This figure is normally carried over from the ending stock of the earlier interval.

Reference To Operating Margin

Every time you incur an expense associated to stock, create a journal entry on your books with the correct expense class. When you pull a revenue and loss (P&L) sheet, your COGS will seem on the income statement underneath sales. Operational costs corresponding to advertising, sales pressure expenses, and after-sales help are not https://www.kelleysbookkeeping.com/ included in COGS. These costs can be substantial and are very important for driving gross sales and supporting the product’s market position.

Overview Of All Merchandise

COGS is a big business expense that impacts your backside line. Thus, traders consider it when deciding whether to spend cash on you (and how a lot to invest). Understanding your COGS helps lenders and investors precisely assess your corporation’s potential and profitability.

Would you like to visit Haridwar? Travel agents in Haridwar are the best place to plan your trip. You can book your tour right here.

Beneath generally accepted accounting rules (GAAP), COGS refers solely to the worth of stock gadgets bought during a given interval. Since purely service-based businesses sometimes don’t hold stock, they don’t have any COGS to report. If a company’s income statement doesn’t record COGS, there isn’t any deduction for these prices. Price of goods offered (COGS) represents the direct prices of manufacturing or buying the products an organization sells, corresponding to materials and labor. It excludes oblique bills, similar to distribution prices and gross sales force costs.