Europe Migraine Treatment Market: Navigating Innovation and Accessibility

Introduction

Migraine ranks among the most disabling neurological disorders in Europe, affecting an estimated 1 in 7 adults. Symptoms include throbbing headaches, nausea, sensitivity to light or sound, and aura phenomena. Chronic migraines impose a significant toll on quality of life, healthcare systems, and productivity. The growing prevalence and recognition of migraine as a major health concern are driving rapid advances in diagnostics, therapies, and digital care models.

The Europe migraine treatment market spans over-the-counter pain relievers, prescription medications, CGRP-targeted therapies, neuromodulation devices, and digital health tools. Patient demand, heightened clinical awareness, and the rise of novel preventive solutions are reshaping the landscape. Europe holds ~26% of the global migraine drug market and is seeing strong momentum across both acute and preventive treatment categories.

Source: https://www.databridgemarketresearch.com/reports/europe-migraine-treatment-market

Do you want to visit Char Dham? Char Dham Travel Agent is the best place to plan your Char Dham tour. You can book the tour from here.

The Evolution

Migraine treatment in Europe began with basic analgesics and ergot derivatives, progressing through the 1990s with triptans, a class of serotonin receptor agonists designed to abort acute attacks. Triptans revolutionized acute care yet offered no preventive benefits.

A major shift came in 2018 with the U.S. FDA approval of the first CGRP monoclonal antibodies and oral gepants like atogepant in 2021 (approved in the EU in August 2023). Preventive therapies with eptinezumab (Vyepti) and fremanezumab (Ajovy) gained EU approval in 2022 and 2019 respectively. Acute treatment evolved too, with lasmiditan (Reyvow) and ubrogepant (Ubrelvy) emerging as new non-vasoconstrictive options.

In parallel, wearable neuromodulation devices and digital tracking apps (e.g., Migraine Buddy) began to complement pharmacological care. Europe also saw increased interest in non-pharmacological interventions including cognitive behavioral therapy and neuromodulation.

Would you like to visit Indiar? A tour operator in India is the best place to plan your tour. You can book a tour from here.

Market Trends

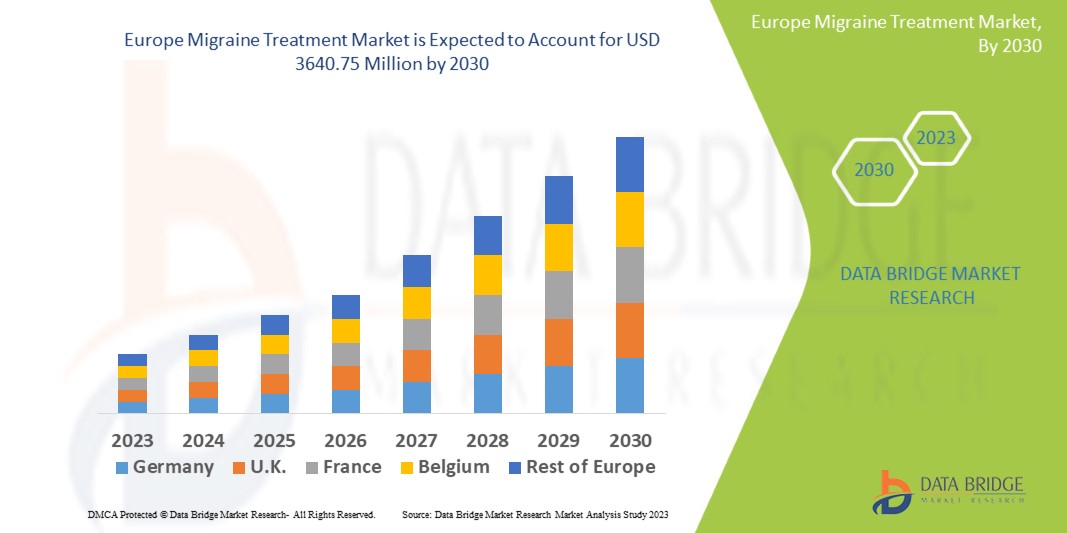

Steady 10.3% CAGR projected from 2025 to 2030, rising from USD 1.77 bn in 2024 to USD 3.19 bn in 2030. Key trends shaping European migraine treatment:

- Surge in OTC use with nearly 62% of market share from self-medication.

- Preventive CGRP therapies rapidly gaining traction; biologics like fremanezumab, eptinezumab and AR inhibition gepants showing strong clinical uptake.

- Digital health integration, with telemedicine, headache tracking apps, and AI-driven tools used more widely.

- Non-pharmacological approaches such as CBT, acupuncture, neuromodulation gaining traction as adjunctive or alternative treatments .

- Personalized medicine shift, focusing on tailored therapies based on patient phenotype, genetics, and treatment response .

- Biologic adoption challenges governed by national HTA frameworks (e.g., AMNOG in Germany, NICE in UK) impacting drug rollout.

- Cost concerns for novel therapies prompting payer scrutiny, though long-term cost-offset through reduced ER visits shows promise.

Challenges

High drug and device cost remains a barrier. CGRP biologics may exceed USD 6,000/year, straining healthcare budgets and patient affordability. Regulatory delays and fragmented reimbursement policies across Europe hinder uniform access.

Underdiagnosis persists; many patients still rely on OTC medications without medical guidance, leading to suboptimal control. Neurologist wait times remain long in many countries. Side effects, variable efficacy, and trial-and-error treatment regimens reduce adherence .

Would you like to visit Haridwar? Travel agents in Haridwar are the best place to plan your trip. You can book your tour right here.

Data privacy and interoperability issues limit digital health adoption. Market competition from generics and lower-cost alternatives adds downward pricing pressure .

Market Scope

Product Type

- Over‑the‑Counter (OTC): NSAIDs, acetaminophen, aspirin

- Prescription – Acute: Triptans, ditans (lasmiditan), gepants (ubrogepant)

- Prescription – Preventive: CGRP monoclonal antibodies, gepants (atogepant), botulinum toxin, beta-blockers, anticonvulsants

- Non‑pharmacological: Neuromodulation devices (e.g., TMS), behavioral therapies, physical methods

Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

- Digital health platforms

End User

- Adult migraine patients

- Chronic migraine sufferers

- Pediatric and adolescent patients

- Occupational health and corporate wellness users

Country

- Germany, UK, France, Italy, Spain, Netherlands, Sweden, rest of Europe

Treatment Approach

- Pharmacological

- Digital/telehealth

- Device-based therapy

- Complementary and alternative therapies

Market Size

Europe’s migraine treatment market reached USD 1.77 bn in 2024. OTC segment accounts for ~62%, followed by acute and preventive prescription drugs. Forecasted growth to USD 3.19 bn by 2030 at a 10.3% CAGR.

Germany leads with highest CAGR in drug uptake (~4.2%), bolstered by strong HTA and digital app reimbursements. UK shows similar pace but is cautious on biologics due to NHS policies. Italy grows slower (~3.5%) due to market fragmentation .

Emerging European markets display higher growth due to increased diagnosis, telehealth expansion, and lifestyle changes.

Factors Driving Growth

Rising Migraine Prevalence

Affecting ~15% of the population, migraines generate high clinical demand. As awareness grows, diagnosis and treatment rates increase.

Advanced Therapeutic Options

Entry of CGRP inhibitors, gepants, ditans, and neuromodulation represents paradigm shifts, offering better efficacy and fewer side effects.

Digital Health Integration

Telemedicine adoption accelerated during COVID-19, boosting prescription access, remote monitoring, and digital symptom tracking .

Patient-Centric and Value-Based Care

Real-world outcomes, reduced absenteeism, and improved quality of life justify investment in expensive therapies .

Regulatory Adaptation

EMA’s PRIME and fast-track schemes accelerate approval of high-impact migraine treatments . Germany and UK pilot digital health reimbursement.

Personalized Medicine

Genetic profiling and AI support tailored interventions, improving response rates and patient satisfaction .

Workplace Health Programs

Corporate wellness initiatives include migraine control, reducing productivity loss and healthcare costs.

Market Diversification

Expanding product mix includes oral gepants, injectable biologics, CGRP biosimilars, neuromodulation devices, and digital therapies.

Public-Private Reimbursement Models

Pilot programs coupling public insurance with private therapies expand access while managing cost.

Research Collaborations

Europe’s robust R&D ecosystem fosters clinical trials, cross-border data initiatives, and biotech-pharma partnerships.